UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| | | | | | |

| Filed by the Registrant | þ | | Filed by a Party other than the Registrant | | o |

| | | | | | | |

| Check the appropriate box: | | | | | |

| o | Preliminary Proxy Statement | | | | |

| | | | | | | |

| o | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2) | | |

| | | | | | | |

| þ | Definitive Proxy Statement | | | | |

| | | | | | | |

| o | Definitive Additional Materials | | | | |

| | | | | | | |

| o | Soliciting Material Pursuant to §240.14a-12 | | | | |

ASPEN INSURANCE HOLDINGS LIMITED

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant) |

| | | |

| Payment of Filing Fee (Check the appropriate box): | |

| | | | |

| þ | No fee required. | |

| | | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | | |

| | (1) | Title of each class of securities to which transaction applies: | |

| | | | |

| | (2) | Aggregate number of securities to which transaction applies: | |

| | | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | | | |

| | (4) | Proposed maximum aggregate value of transaction: | |

| | | | |

| | (5) | Total fee paid: | |

| | | | |

|

| | | |

| o | Fee paid previously with preliminary materials | |

| | | | |

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| | | | |

| | (1) | Amount Previously Paid: | |

| | | | |

| | (2) | Form, Schedule or Registration Statement No.:

| |

| | | | |

| | (3) | Filing Party: | |

| | | | |

| | (4) | Date Filed: | |

| | | | |

ASPEN INSURANCE HOLDINGS LIMITED

Notice of 2016 Annual General Meeting of Shareholders

andNOTICE OF ANNUAL MEETING

Proxy StatementAND PROXY STATEMENT

May 2, 2018

ASPEN INSURANCE HOLDINGS LIMITED

141 Front Street

Hamilton HM19

Bermuda

IMPORTANT ASPEN INSURANCE HOLDINGS LIMITED

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THEANNUAL MEETING OF SHAREHOLDERS

SHAREHOLDER MEETING TO BE HELD ON APRIL 21, 2016

To our Shareholders:Dear shareholders:

The 2018 annual general meeting of shareholders of Aspen Insurance Holdings Limited (the “Company” or “Aspen Holdings”“our”) will be held at the offices of the Company, 141 Front Street, Hamilton HM19, Bermuda on April 21, 2016May 2, 2018 at 12.00 p.m. Local Timelocal time (the “Annual General“2018 Annual Meeting”).

The matters intended to be acted upon at the 2018 Annual General Meeting are as follows:

| |

| 1. | Toto re-elect Messrs. Ronald PressmanGlyn Jones, Gary Gregg and Gordon Ireland and to elect Mr. Karl MayrBret Pearlman as Class IIIII directors of the Company; |

| |

| 2. | Toto provide a non-binding advisory vote approving the compensation of the Company’s named executive officers set forth in the proxy statement (“Say-On-Pay Vote”); |

| |

| 3. | To approve the Company’s 2016 Stock Incentive Plan for Non-Employee Directors; |

| |

4. | Toto re-appoint KPMG LLP (“KPMG”), London, England, to act as the Company’s independent registered public accounting firm and auditor for the fiscal year ending December 31, 20162018 and to authorize the Company’s Board of Directors of the Company (the “Board”) through the Audit Committee to set the remuneration for KPMG; and |

| |

5.4. | Toto consider such other business as may properly come before the 2018 Annual General Meeting or any adjournments thereof. |

The Company will also lay before the meeting2018 Annual Meeting the audited financial statements of the Company for the fiscal year ended December 31, 20152017 pursuant to the provisions of the Bermuda Companies Act 1981, as amended, and the Company’s Bye-Laws.

The close of business on February 22, 2016March 5, 2018 (the “Record Date”) has been fixed as the record date for determining the shareholders entitled to notice of, and to vote at, the 2018 Annual General Meeting or any adjournments thereof. For a period of at least ten (10) days prior to the 2018 Annual General Meeting, a list of shareholders entitled to vote at the 2018 Annual General Meeting will be open for examination by any shareholder during ordinary business hours at the Company’s office located at 141 Front Street, Hamilton HM19, Bermuda.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDER MEETING TO BE HELD ON APRIL 21, 2016

The Proxy Statement, the Notice of Internet Availability of Proxy Materials and the Annual Report on

Form 10-K for the fiscal year ended December 31, 20152017 are available at http://www.edocumentview.com/AHL and http://www.aspen.co.

The Company has taken advantage of the U.S. Securities and Exchange Commission rule allowing companies to furnish proxy materials via the Internet.internet. On or about March 10, 2016,19, 2018, the Company will mail a Notice of Internet Availability of Proxy Materials (“Notice”) to allthe Company’s shareholders as of the record date, February 22, 2016.Record Date. The Notice will contain instructions on how to gain access to the Company’s Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2015.2017. In addition, the Notice will contain instructions to allow shareholders to request copies of the proxy materials by mail. The proxy materials sent by mail will include a proxy card containing instructions to submit your proxy via the Internetinternet or telephone, or alternatively you may complete, sign, date and return the proxy card by mail.

YOUR VOTE IS IMPORTANT

If you are unable to be present at the 2018 Annual General Meeting personally, please follow the instructions for submitting your proxy on the Notice you received for the meeting2018 Annual Meeting or, if you requested a paper copy of our proxy materials, by completing, signing, dating and returning your proxy card, or by Internetvia the internet or telephone as described on your proxy card.

By Order of the Board of Directors,

Michael Cain

Group General Counsel and Company Secretary

Hamilton, Bermuda

March 10, 201619, 2018

ASPEN INSURANCE HOLDINGS LIMITEDTABLE OF CONTENTS

Hamilton HM19

Bermuda

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on April 21, 2016

The Proxy Statement, the Notice of Internet Availability of Proxy Materials and the Annual Report on Form 10-K for the year ended December 31, 2015 are available at

http://www.edocumentview.com/AHL and http://www.aspen.co

GENERAL INFORMATION

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Aspen Insurance Holdings Limited (the “Company,” “we,” “us” or “our”) to be voted at our annual general meeting of shareholders to be held at the offices of the Company located at 141 Front Street, Hamilton HM19, Bermuda on April 21, 2016 at 12:00 p.m. local time, or at such other meeting upon any postponement or adjournment thereof (the “Annual General Meeting”). Directions to the Annual General Meeting may be obtained by contacting the Company at 1 (441) 295-8201. This Proxy Statement, the Notice of Internet Availability of Proxy Materials and the accompanying form of proxy are being first mailed to shareholders on or about March 10, 2016. These proxy materials, along with a copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, are also available for viewing at http://www.edocumentview.com/AHL and http://www.aspen.co.

Shareholders will be asked to take the following actions at the Annual General Meeting:

|

| | | |

1. | | Page |

|

| Proxy Statement Highlights | | |

|

| General Information about the 2018 Annual Meeting | | |

|

| Board Directors of the Company | | |

|

| Director Independence | | 15 |

|

| Committees of the Board of Directors | | 15 |

|

| Code of Conduct, Corporate Governance Guidelines and Committee Charters | | 16 |

|

| Board Leadership Structure | | 16 |

|

| Attendance at Meetings by Directors | | 17 |

|

| Non-Executive Directors | | 17 |

|

| 2017 Non-Executive Director Compensation | | 17 |

|

| Submission of Shareholder Proposals for 2019 | | 19 |

|

| Policy on Shareholder Proposals for Director Nominees | | 20 |

|

| Communications to the Board of Directors | | 22 |

|

| Householding | | 22 |

|

| Annual Report on Form 10-K | | 22 |

|

| Executive Officers | | 23 |

|

| Role in Risk Oversight | | 27 |

|

| Review and Approval of Transactions with Related-Persons | | 29 |

|

| Compensation Committee Interlocks and Insider Participation | | 29 |

|

| Compensation Discussion and Analysis | | |

|

| Executive Summary | | |

|

| Overview of 2017 Results | | |

|

| 2017 Performance Highlights | | 31 |

|

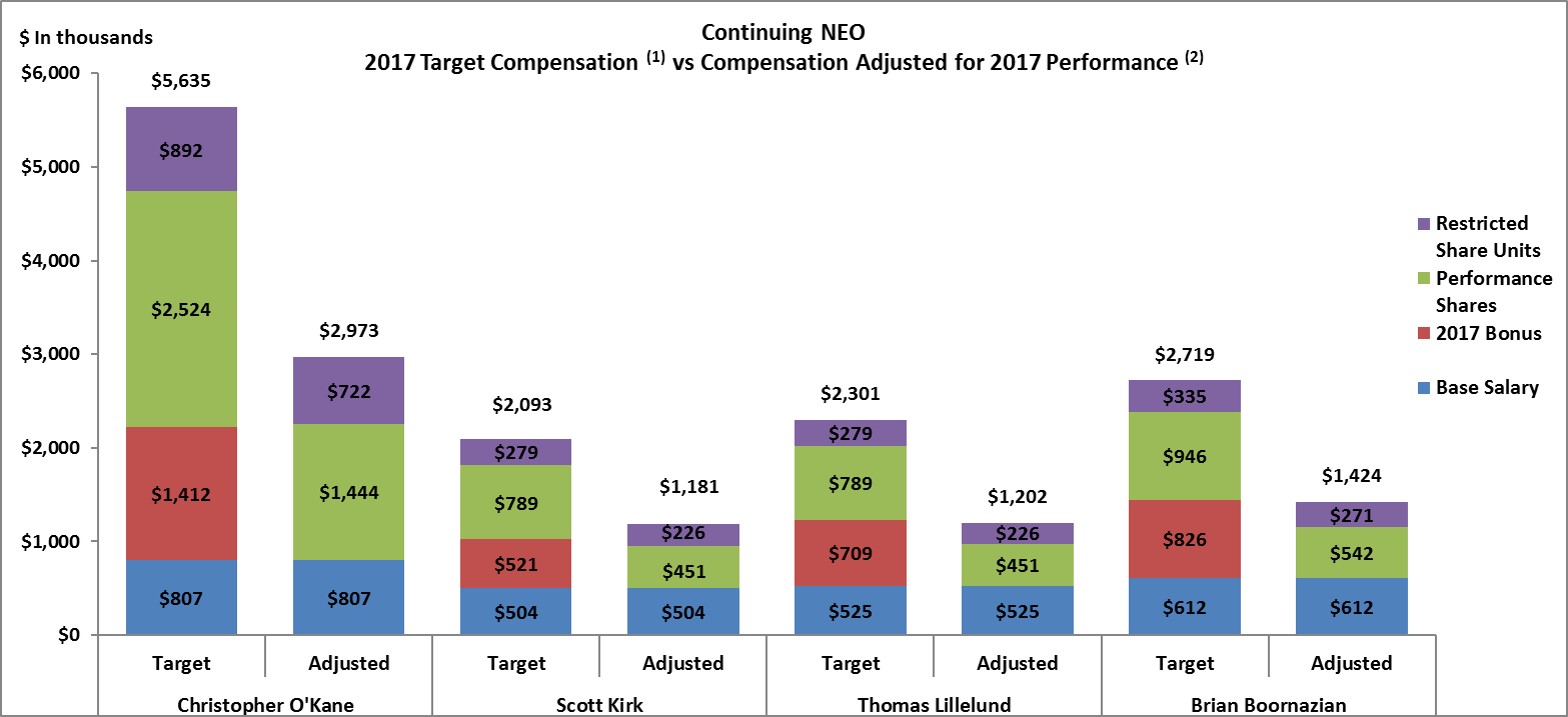

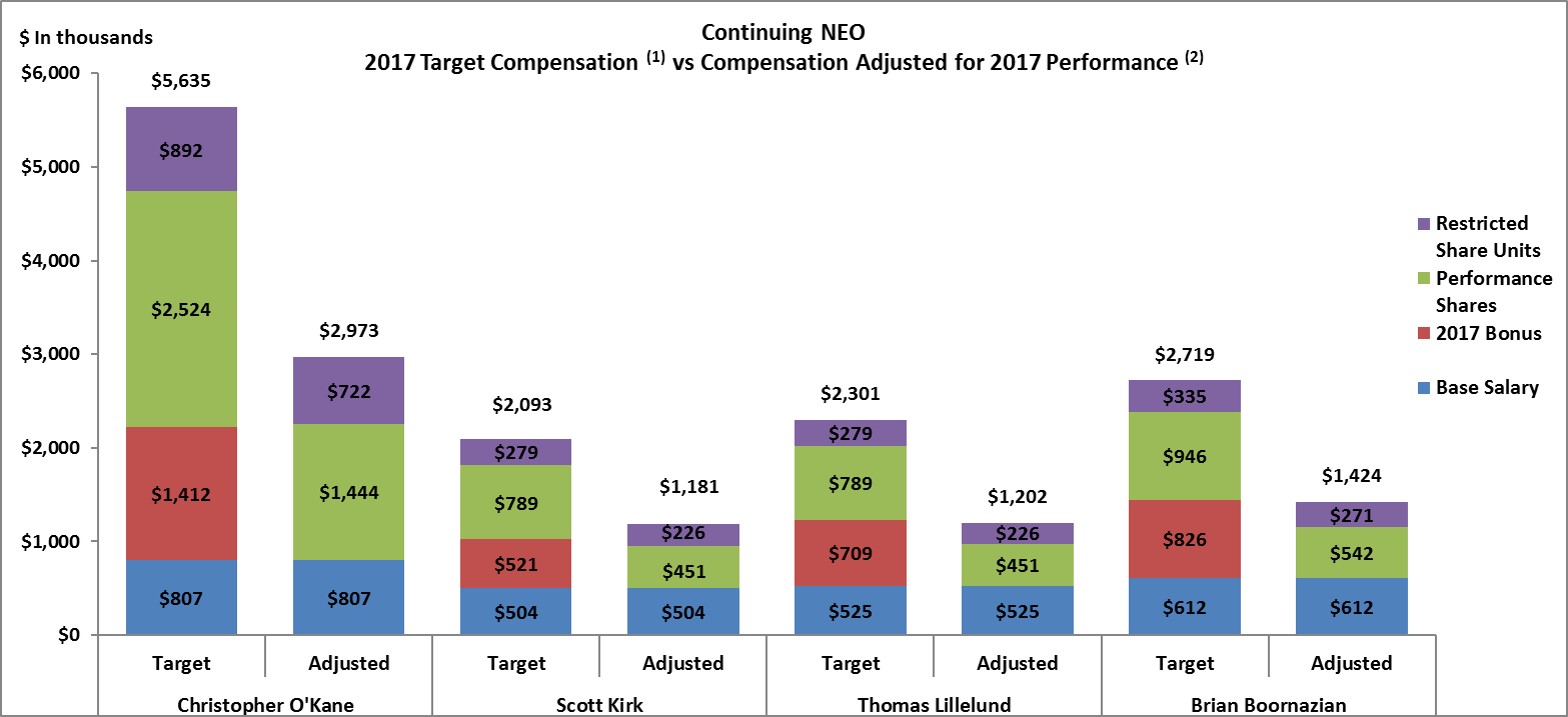

| 2017 Compensation Highlights for the NEOs | | 32 |

|

| Link Between Pay and Performance | | 32 |

|

| Executive Compensation Program and Philosophy | | 33 |

|

| Market Intelligence | | 34 |

|

| Determining Individual Compensation Levels | | 35 |

|

| Elements of Compensation | | 37 |

|

| Executive Compensation Governance and Process | | 43 |

|

| 2017 Summary Compensation Table | | |

|

| 2017 Grants of Plan-based Awards | | |

|

| Outstanding Equity Awards | | |

|

| Shares Vested During 2017 | | 52 |

|

| 2017 Nonqualified Deferred Compensation | | 52 |

|

| Chief Executive Officer Pay Ratio | | |

|

| Retirement Benefits | | |

|

| Potential Payments Upon Termination or Change of Control | | |

|

| Compensation Policies and Risk | | |

|

| Compensation Committee Report | | 58 |

|

| Audit Committee Report | | 59 |

|

| Beneficial Ownership | | |

|

| Section 16(a) Beneficial Ownership Reporting Compliance | | 61 |

|

| Proposals | | |

|

| Reconciliation of Non-U.S. GAAP Financial Measures | | |

|

PROXY STATEMENT HIGHLIGHTS

Voting Items

|

| | |

| | Proposal 1: Election of Directors(Page 62) |

| The Board recommends you vote FOR each nominee |

| | |

| | Proposal 2: Non-Binding Vote to Approve Aspen’s 2017 Executive Compensation (“Say-On-Pay Vote”) (Page 63) |

| The Board recommends you vote FOR this proposal |

| | |

| | Proposal 3: Reappointment of KPMG LLP as the Company’s Independent Registered Public Accounting Firm(Page 64) |

| The Board recommends you vote FOR this proposal |

| | |

|

| | | | |

| 2018 Annual Meeting and Voting Information | | Board and Corporate Governance Highlights |

| | | | The nominees for the Board of Directors each have the qualifications and experience to approve and guide the strategy of Aspen and to oversee management’s execution of that strategic vision while mitigating risk and operating within a complex regulatory environment. |

| | Date and Time | |

| May 2, 2018 at 12:00 p.m. (ADT) | | |

| | | |

| | Place | |

| 141 Front Street, Hamilton HM19, Bermuda | |

| | | |

| | Record Date | |

| March 5, 2018 | |

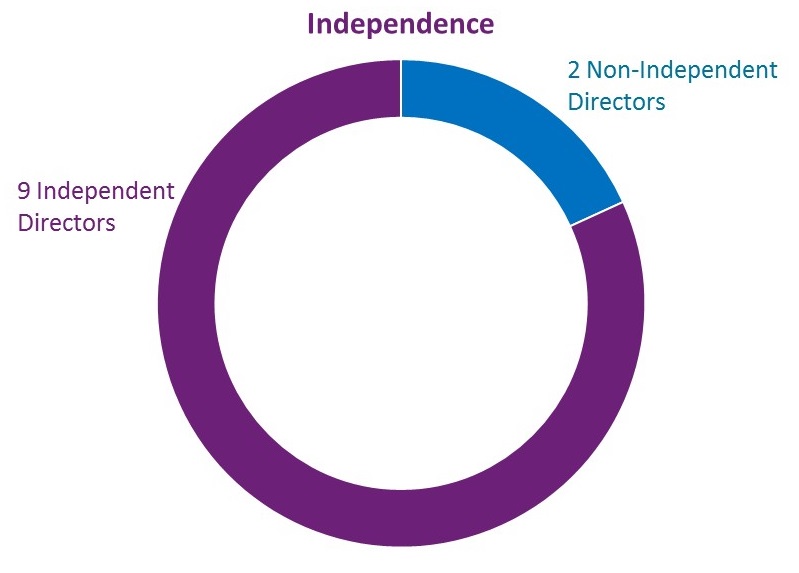

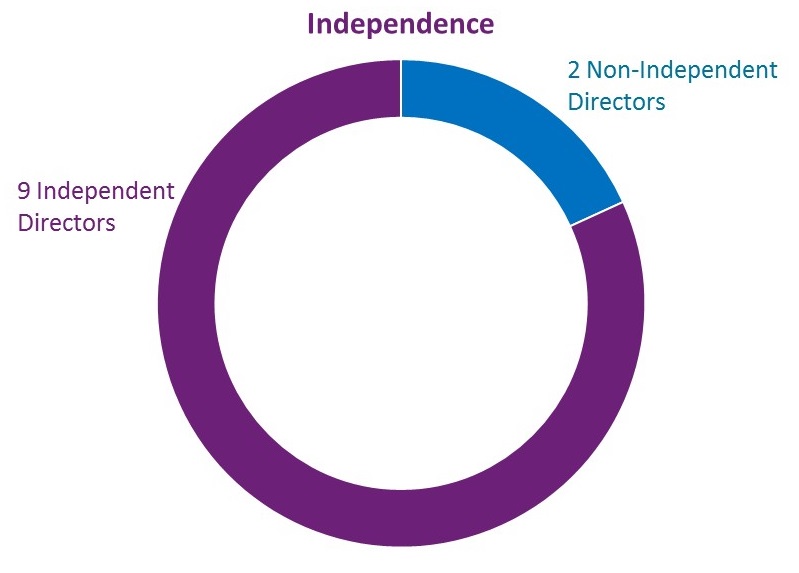

| | | | 82% of our directors are independent |

| | | | |

| | Voting | |

| Shareholders as of the Record Date are entitled to vote. Holders of ordinary shares are entitled on a poll to one vote for each ordinary share held on each matter to be voted upon by the shareholders at the 2018 Annual Meeting. | |

| | | |

| | Admission | |

| To attend the 2018 Annual Meeting in person, shareholders who are not holders of record must bring evidence of such ownership and provide personal identification (such as a driver’s license or passport). | |

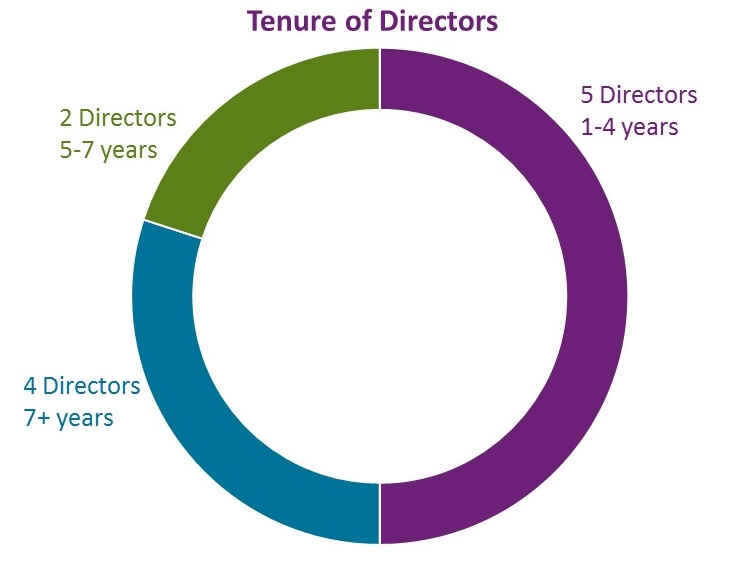

| | | | The average tenure of our directors is 7.2 years as of December 31, 2017 |

Aspen understands that corporate governance practices evolve over time and seeks to adopt practices that we believe will be of value to our shareholders and positively aid in Aspen’s governance. Highlights include the following:

|

| | |

| Alignment with Shareholders: | | Compensation Governance: |

ü Separate positions for the Chair of the Board and Group Chief Executive Officer since inception ü Lead Independent Director since 2014 ü Shareholders have the right to a call a special meeting and to act by written consent ü Non-management directors meet in executive session at least quarterly ü Majority vote FORstandard for director elections ü Annual Board and committee evaluations

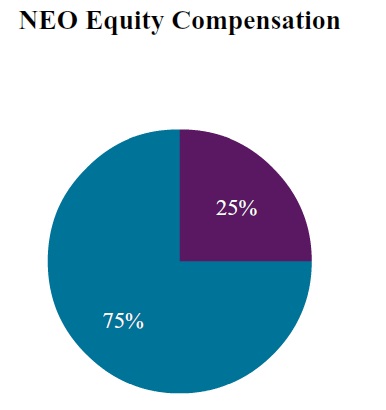

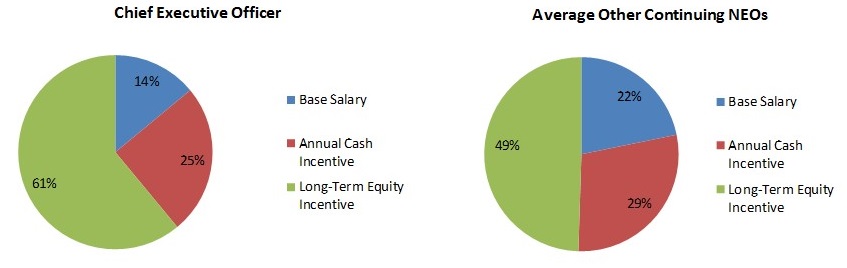

| | ü Say on pay advisory vote considered by shareholders annually ü 75% of NEOs’ long-term incentive compensation is performance-based ü Compensation Committee retains an independent compensation consultant ü Clawback policy applies to all employees ü Members of the re-electionGroup Executive Committee are subject to double trigger change of control provisions ü All officers and directors are subject to our long-standing policy prohibiting pledging and hedging ownership of Aspen’s ordinary shares ü Share ownership guidelines for all directors and members of the Group Executive Committee

|

|

|

|

|

|

|

|

|

|

|

|

General Information About the 2018 Annual Meeting

|

| | |

| Q: | | Why am I receiving these materials? |

| A: | | You are receiving this proxy statement (this “Proxy Statement”) because you are a shareholder of Aspen Insurance Holdings Limited (the “Company,” “Aspen,” “we,” “us” or “our” and, together with its subsidiaries, the “Group”) as of March 5, 2018 (the “Record Date”). These proxy materials, along with a copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017, are also available for viewing at http://www.edocumentview.com/AHL and http://www.aspen.co.

|

| Q: | | Where and when will the 2018 Annual Meeting take place? |

| A: | | The 2018 annual general meeting of shareholders of the Company (the “2018 Annual Meeting”) will be held at 141 Front Street, Hamilton HM19, Bermuda on May 2, 2018 at 12:00 p.m. (ADT). Directions to the 2018 Annual Meeting may be obtained by contacting the Company at +1 (441) 295-8201. |

| Q: | | Why did I receive a one page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials? |

| A: | | The Company has taken advantage of the U.S. Securities and Exchange Commission (the “SEC”) rule allowing companies to furnish proxy materials via the internet instead of a paper copy. This process allows us to expedite our shareholders’ receipt of proxy materials, lower the costs of distribution and reduce the environmental impact of our 2018 Annual Meeting. If you would like to receive a printed set of the proxy materials, please follow the instructions described in the Notice to request printed materials. |

| Q: | | What will I be voting on? |

| A: | | Shareholders will be asked to take the following actions at the 2018 Annual Meeting: ● to re-elect Messrs. Ronald PressmanGlyn Jones, Gary Gregg and Gordon Ireland and the election of Mr. Karl MayrBret Pearlman as Class IIIII directors of the Company; |

| |

2. | To | ● to provide a non-binding vote FORapproving the approval of compensation of the Company’s named executive officers as set forth in this Proxy Statement as part of the non-binding, advisory say-on-pay vote (“Say-On-Pay Vote”); |

| and |

3. | To vote FOR the adoption of the Company’s 2016 Stock Incentive Plan for Non-Employee Directors; and |

| |

4. | To vote FOR the re-appointment of● to re-appoint KPMG LLP (“KPMG”), London, England, to act as the Company’s independent registered public accounting firm and auditor for the fiscal year ending December 31, 20162018 and to authorize the Company’s Board of Directors (the “Board”) through the Audit Committee (the “Audit Committee”) to set the remuneration for KPMG. |

| Q: | | Could other matters be decided at the 2018 Annual Meeting? |

| A: | | As of the date of this Proxy Statement, the Board knows of no matters that will be presented for consideration at the 2018 Annual Meeting other than as described in this Proxy Statement. If any other matters shall properly come before the 2018 Annual Meeting and shall be voted on, the proxy holders will be deemed to confer discretionary authority on the individuals named as proxies therein to vote the shares represented by such proxies as to any of those matters. The persons named as proxies intend to vote in accordance with the recommendation of the Board or otherwise in their best judgment.

|

| Q: | | What are the voting recommendations of the Board? |

| A: | | The Board unanimously recommends that you vote FOR each of the director nominees and FOR each of the proposals listed above. |

| Q: | | What vote is required to approve each proposal? |

| A: | | Each of the proposals require an affirmative vote of the majority of the voting power of the votes cast and entitled to vote at the 2018 Annual Meeting. |

| Q: | | Who is entitled to vote? |

| A: | | The Board has set March 5, 2018 as the Record Date for the determination of persons entitled to receive notice of, and to vote at, the 2018 Annual Meeting. As of the Record Date, there were 59,563,494 ordinary shares of the Company, par value U.S. 0.15144558 cents per share (the “ordinary shares”), issued and outstanding. The ordinary shares are our only class of equity securities outstanding currently entitled to vote at the 2018 Annual Meeting. |

| Q: | | How many votes do I have? |

| A: | | Holders of ordinary shares are entitled to one vote per each ordinary share held on the Record Date for each matter to be voted upon by the shareholders at the 2018 Annual Meeting. However, if you own Controlled Shares (as defined below) that constitute 9.5% or more of the voting power of all ordinary shares, your voting rights with respect to those Controlled Shares will be limited, in the aggregate, to a voting power of approximately 9.5% pursuant to a formula set forth in our Bye-Laws. Our Bye-Laws define “Controlled Shares” generally to include all ordinary shares that a person is deemed to beneficially own directly, indirectly or constructively within the meaning of Section 958 of the Internal Revenue Code of 1986, as amended. For more information, please refer to the disclosure on voting cutbacks in the Form 10-K for the year ended December 31, 2017 filed with the SEC on February 22, 2018. It is currently expected that there will be no adjustments to the voting power of any of the Company’s shareholders. |

| Q: | | Who is soliciting my vote? |

| A: | | The Board is soliciting your vote at the 2018 Annual Meeting. The Board has designated Christopher O’Kane, Group Chief Executive Officer, and Scott Kirk, Group Chief Financial Officer, as proxies.

|

| | |

Shareholders may be asked to consider such other business as may properly come before the Annual General Meeting or any adjournments thereof.

Proposals 1, 2, 3 and 4 each require an affirmative vote of the majority of the voting power of the votes cast and entitled to vote at the Annual General Meeting (taking into account the Company’s Bye-Laws 63 to 67). The Company intends to conduct all voting at the Annual General Meeting by poll as requested by the Chairman of the Annual General Meeting, in accordance with our Bye-Laws.

As of February 22, 2016, the record date for the determination of persons entitled to receive notice of, and to vote at,

|

| | |

| Q: | | How do I vote? |

| A: | | You can vote by proxy whether or not you attend the 2018 Annual General Meeting, there were 60,762,721 ordinary shares of the Company, par value U.S. 0.15144558 cents per share (the “ordinary shares”), issued and outstanding. The ordinary shares are our only class of equity securities outstanding currently entitled to vote at the Annual General Meeting. Holders of ordinary shares are entitled on a poll to one vote for each ordinary share held on each matter to be voted upon by the shareholders at the Annual General Meeting. To vote by proxy, shareholders have a choice of voting on the internet, by telephone or sending the completed and signed proxy card. Please follow the instructions described in the Notice for more information on how to vote your ordinary shares. |

| Q: | | What constitutes a quorum necessary to transact business at the meeting? |

| A: | | The presence of one or more shareholders in person or by proxy holding at least 50% of the voting power of all of the issued ordinary shares of the Company throughout the 2018 Annual Meeting shall form a quorum for the transaction of business at the 2018 Annual Meeting. |

| | If a quorum is not present, the 2018 Annual Meeting shall stand adjourned to such other day, time and place as the chair of the meeting may determine and at such adjourned meeting two shareholders present in person or by proxy and holding at least 10% in the aggregate of the voting power of ordinary shares entitled to vote at such meeting shall be a quorum. The Company shall give not less than 21 days’ notice of any meeting adjourned through want of a quorum. An adjournment will have no effect on the business that may be conducted at the adjourned meeting. |

| Q: | | What is the difference between a “shareholder of record” and a “street name” holder? |

| A: | | These terms describe the manner in which you hold your ordinary shares. If your ordinary shares are registered directly in your name through our transfer agent, Computershare, you are a “shareholder of record.” If you are a beneficial owner of shares held in the name of a brokerage firm, bank, trust or other nominee as custodian on your behalf, you are a “street name” holder. |

| Q: | | What if I return my proxy but do not indicate how to vote my shares? |

| A: | | If you are a shareholder of record and no instructions are provided in a properly executed proxy, it will be voted FOR all nominees in Proposal 1 and FOR Proposals 2 and 3 and in accordance with the proxyholder’s best judgment as to any other business as may properly come before the 2018 Annual Meeting. If a shareholder of record appoints a person other than the persons named in the enclosed form of proxy to represent him or her, such person will vote the shares in respect of which he or she is appointed proxyholder in accordance with the directions of the shareholder appointing him or her.

To the extent that beneficial owners do not furnish voting instructions with respect to any or all proposals submitted for shareholder action, member brokerage firms of The New York Stock Exchange, Inc. (the “NYSE”) that hold ordinary shares in “street name” for such beneficial owners may not vote in their discretion on non-routine matters, such as Proposals 1 and 2, but have the discretion to vote on routine matters, such as Proposal 3. If beneficial owners do not provide voting instructions to their brokerage firm or other nominee, such brokerage firm or other nominee may only vote their shares on Proposal 3 and any other routine matters properly presented for a vote at the 2018 Annual Meeting. |

| Q: | | How will broker non-votes and abstentions be treated? |

| A: | | Any broker non-votes and abstentions will be counted toward the presence of a quorum at, but will not be considered votes cast on any proposal brought before, the 2018 Annual Meeting. Generally, “broker non-votes” occur when ordinary shares held for a beneficial owner are not voted on a particular proposal because the broker has not received voting instructions from the beneficial owner and the broker does not have discretionary authority to vote the ordinary shares on a particular proposal. |

| Q: | | Can I change my vote? |

| A: | | Yes. Any shareholder who executes a proxy may revoke it at any time before it is voted by (i) delivering to the Company Secretary a written statement revoking such proxy, (ii) executing and delivering a later-dated proxy or (iii) voting in person at the 2018 Annual Meeting. Each ordinary share represented by a properly executed proxy which is returned and not revoked will be voted in accordance with the instructions, if any, given thereon. |

| | Attendance at the 2018 Annual Meeting by a shareholder who has executed and delivered a proxy to us shall not in and of itself constitute a revocation of such proxy. For ordinary shares held in “street name” by a broker, bank or other nominee, new voting instructions must be delivered to the broker, bank or nominee prior to the 2018 Annual Meeting. |

| Q: | | What do I need to bring to attend the 2018 Annual Meeting? |

A:

| | Only shareholders of record or their properly appointed proxies, beneficial owners of the Company’s ordinary shares who have evidence of such ownership and provide personal identification (such as a driver’s license or passport) and the Company’s guests may attend the 2018 Annual Meeting. |

| Q: | | Who pays the costs of soliciting proxies? |

| A: | | We will bear the cost of solicitation of proxies. We have engaged Innisfree M&A Incorporated to be our proxy solicitation agent. For these services, we will pay Innisfree M&A Incorporated a fee of approximately $15,000 plus reasonable expenses. Further solicitation may be made by our directors, officers and employees personally, by telephone, internet or otherwise, but such persons will not be specifically compensated for such services. We may also make, through bankers, brokers or other persons, a solicitation of proxies of beneficial holders of the ordinary shares. Upon request, we will reimburse brokers, dealers, banks or similar entities acting as nominees for reasonable expenses incurred in forwarding copies of the proxy materials relating to the 2018 Annual Meeting to the beneficial owners of ordinary shares which such persons hold of record. |

| Q: | | When will voting results be announced? |

| A: | | Preliminary voting results will be announced at the 2018 Annual Meeting. Final voting results will be filed with the SEC on a Current Report on Form 8-K within four business days following the 2018 Annual Meeting. |

The presence of one or more shareholders in person or by proxy holding at least 50% of the voting power (that is, the number of maximum possible votes of the shareholders entitled to attend and vote at a general meeting, after giving effect to the provision of our Bye-Laws 63 to 67) of all of the issued ordinary shares of the Company throughout the Annual General Meeting shall form a quorum for the transaction of business at the Annual General Meeting. Only recordholders or their properly appointed proxies, beneficial owners of the Company’s ordinary shares who have evidence of such ownership and provide personal identification (such as a driver’s license or passport) and the Company’s guests may attend the Annual General Meeting.

Pursuant to our Bye-Laws 63 to 67, the voting power of all ordinary shares is adjusted to the extent necessary so that there is no 9.5% U.S. Shareholder. For the purposes of our Bye-Laws, a “9.5% U.S. Shareholder” is defined as a United States Person (as defined in the Internal Revenue Code of 1986, as amended, of the United States (the “Code”)) whose “controlled shares” (as defined below)

constitute 9.5% or more of the voting power of all ordinary shares and who would be generally required to recognize income with respect to the Company under Section 951(a)(1) of the Code, if the Company were a controlled foreign corporation as defined in Section 957 of the Code and if the ownership threshold under Section 951(b) of the Code were 9.5%.

The applicability of the voting power reduction provisions to any particular shareholder depends on facts and circumstances that may be known only to the shareholder or related persons. Accordingly, the Company requests that any holder of ordinary shares with reason to believe that it is a 9.5% U.S. Shareholder (as described above) contact the Company promptly so that the Company may determine whether the voting power of such holder’s ordinary shares should be reduced. By submitting a proxy, unless the Company has otherwise been notified or made a determination with respect to a holder of ordinary shares, a holder of ordinary shares will be deemed to have confirmed that, to its knowledge, it is not, and is not acting on behalf of, a 9.5% U.S. Shareholder.

In order to determine the number of controlled shares owned by each shareholder, we are authorized to require any shareholder to provide such information as the Board may deem necessary for the purpose of determining whether any shareholder’s voting rights are to be adjusted pursuant to the Company’s Bye-Laws. We may, in our reasonable discretion, disregard the votes attached to ordinary shares of any shareholder failing to respond to such a request or submitting incomplete or inaccurate information. “Controlled shares” will include, among other things, all ordinary shares that a person is deemed to beneficially own directly, indirectly or constructively (as determined pursuant to Sections 957 and 958 of the Code).

Pursuant to our Bye-Laws 63 to 67, it is currently expected that there will be no adjustments to the voting power of any of the Company’s shareholders. Therefore, every shareholder will be entitled on a poll to one vote for each ordinary share held by such shareholder on each matter to be voted upon.

The Company’s Bye-Law 84 provides that if the voting rights of any shares of the Company are adjusted pursuant to Bye-Laws 63 to 67 and the Company is required or entitled to vote at a general meeting of any of its subsidiaries organized under the laws of a jurisdiction outside of the United States of America (each, a “Non-U.S. Subsidiary”), the Board shall refer the subject matter of the vote to shareholders of the Company on a poll and seek authority from the shareholders in a general meeting of the Company for the Company’s corporate representative or proxy to vote in favor of the resolutions proposed by such Non-U.S. Subsidiary pro rata to the votes received at the general meeting of the Company’s corporate representative or proxy to vote against the directing resolution being taken, respectively, as an instruction for the Company’s corporate representative or proxy to vote in the appropriate proportion of its shares for, and the appropriate proportion of its shares against, the resolution proposed by the Non-U.S. Subsidiary.

At the Company’s 2009 annual general meeting, shareholders approved resolutions amending the constitutional documents of the Company and its Non-U.S. Subsidiaries to modify each of their respective voting push-up provisions (which mirror those of the Company described in the preceding paragraph) found in such constitutional documents, so that such provision is only applicable in the event that the voting rights of any shares of the Company are adjusted pursuant to the Company’s Bye-Laws 63-67. If voting rights are not adjusted pursuant to the above, resolutions proposed by the Company’s Non-U.S. Subsidiaries will not be voted upon by the Company’s shareholders at the Annual General Meeting.

PRESENTATION OF FINANCIAL STATEMENTS

In accordance with the Bermuda Companies Act 1981, as amended, and Bye-Law 139 of the Company, the Company’s audited financial statements for the year ended December 31, 2015 were approved by the Board and will be presented at the Annual General Meeting. There is no requirement under Bermuda law that these statements be approved by shareholders and no such approval will be sought at the Annual General Meeting.

SOLICITATION AND REVOCATION

PROXIES IN THE FORM ENCLOSED ARE BEING SOLICITED BY, OR ON BEHALF OF, THE BOARD. THE

BOARD HAS DESIGNATED THE PERSONS NAMED IN THE ACCOMPANYING FORM OF PROXY AS PROXIES. Such persons designated as proxies serve as officers of the Company. Any shareholder desiring to appoint another person to represent him or her at the Annual General Meeting may do so either by inserting such person’s name in the blank space provided on the accompanying form of proxy or by completing another form of proxy and, in either case, delivering an executed proxy to the Company Secretary at the address indicated on page 3 of this Proxy Statement prior to the Annual General Meeting. It is the responsibility of the shareholder appointing such other person to represent him or her to inform such person of this appointment.

Each ordinary share represented by a properly executed proxy which is returned and not revoked will be voted in accordance with the instructions, if any, given thereon. If no instructions are provided in a properly executed proxy, it will be voted “FOR” all nominees in Proposal 1, “FOR” Proposals 2, 3 and 4 and in accordance with the proxyholder’s best judgment as to any other business as may properly come before the Annual General Meeting. If a shareholder appoints a person other than the persons named in the enclosed form of proxy to represent him or her, such person will vote the shares in respect of which he or she is appointed proxyholder in accordance with the directions of the shareholder appointing him or her. Any shareholder who executes a proxy may revoke it at any time before it is voted by (i) delivering to the Company Secretary a written statement revoking such proxy, (ii) executing and

delivering a later-dated proxy or (iii) voting in person at the Annual General Meeting. Attendance at the Annual General Meeting by a shareholder who has executed and delivered a proxy to us shall not in and of itself constitute a revocation of such proxy. For ordinary shares held in “street name” by a broker, bank or other nominee, new voting instructions must be delivered to the broker, bank or nominee prior to the Annual General Meeting.

To the extent that beneficial owners do not furnish voting instructions with respect to any or all proposals submitted for shareholder action, member brokerage firms of The New York Stock Exchange, Inc. (the “NYSE”) that hold ordinary shares in “street name” for such beneficial owners may not vote in their discretion on non-routine matters, such as Proposals 1, 2 and 3, but have the discretion to vote on routine matters, such as Proposal 4. If beneficial owners do not provide voting instructions to their brokerage firm or other nominee, such brokerage firm or other nominee may therefore only vote their shares on Proposal 4 and any other routine matters properly presented for a vote at the Annual General Meeting.

Any “broker non-votes” and abstentions will be counted toward the presence of a quorum at, but will not be considered votes cast on any proposal brought before, the Annual General Meeting. Generally, “broker non-votes” occur when ordinary shares held for a beneficial owner are not voted on a particular proposal because the broker has not received voting instructions from the beneficial owner and the broker does not have discretionary authority to vote the ordinary shares on a particular proposal. If a quorum is not present, the Annual General Meeting shall stand adjourned to such other day and such other time and place as the chairman of the meeting may determine and at such adjourned meeting two (2) shareholders present in person or by proxy and holding at least ten percent (10%) in the aggregate of the voting power of shares entitled to vote at such meeting (taking into account the Company’s Bye-Laws 63-67) shall be a quorum. The Company shall give not less than twenty-one (21) days’ notice of any meeting adjourned through want of a quorum and such notice shall state that two (2) shareholders present in person or by proxy and holding at least ten percent (10%) in the aggregate of the voting power of shares entitled to vote at such meeting (taking into account the Company’s Bye-Laws 63-67) shall be a quorum. An adjournment will have no effect on the business that may be conducted at the adjourned meeting.

We will bear the cost of solicitation of proxies. We have engaged Innisfree M&A Incorporated to be our proxy solicitation agent. For these services, we will pay Innisfree M&A Incorporated a fee of approximately $15,000 plus reasonable expenses. Further solicitation may be made by our directors, officers and employees personally, by telephone, Internet or otherwise, but such persons will not be specifically compensated for such services. We may also make, through bankers, brokers or other persons, a solicitation of proxies of beneficial holders of the ordinary shares. Upon request, we will reimburse brokers, dealers, banks or similar entities acting as nominees for reasonable expenses incurred in forwarding copies of the proxy materials relating to the Annual General Meeting to the beneficial owners of ordinary shares which such persons hold of record.

MANAGEMENT

Board of Directors of the Company

Our Bye-Laws provide forThe Company has a classified Board that is divided into three classes of directors, with each class elected to serve a term of three years. Our incumbent Class IAs of March 1, 2018, we had the following directors were elected at our 2014 annual general meetingon the Board and are scheduled to serve until our 2017 annual general meeting. committees of the Board:

|

| | | | | | | | | | | | | | | |

| Name | | Age | | Director Since | | Audit | | Compensation | | Corporate

Governance & Nominating | | Investment | | Risk | Lead Independent Director |

| Class I Directors: | | | | | | | | | | | | | | | |

| Christopher O’Kane | | 63 | | 2002 | | | | | | | | | | | |

| Heidi Hutter | | 60 | | 2002 | | ● | | | | C | | | | ● | ● |

| John Cavoores | | 60 | | 2006 | | | | | | ● | | | | ● | |

| Albert Beer | | 67 | | 2011 | | ● | | | | | | | | ● | |

| Matthew Botein | | 44 | | 2017 | | | | | | | | C | | | |

| Class II Directors: | | | | | | | | | | | | | | | |

| Glyn Jones (Chair) | | 65 | | 2006 | | | | | | | | ● | | | |

| Gary Gregg | | 62 | | 2013 | | ● | | ● | | | | | | C | |

| Bret Pearlman | | 51 | | 2013 | | | | ● | | ● | | ● | | | |

| Class III Directors: | | | | | | | | | | | | | | | |

| Ronald Pressman | | 59 | | 2011 | | | | C | | | | ● | | | |

| Gordon Ireland | | 64 | | 2013 | | C | | | | | | | | ● | |

| Karl Mayr | | 67 | | 2015 | | ● | | ● | | | | | | ● | |

___________

● Committee Member

C Committee Chair

Our incumbent Class II directors were elected at our 2015 annual general meeting of shareholders and are scheduled to serve until ourstanding for re-election at the 2018 annual general meeting.Annual Meeting. Our incumbent Class III directors were elected at our 20132016 annual general meeting of shareholders and will be subject for (re)electionare scheduled to serve until our 2019 annual general meeting of shareholders. Our incumbent Class I directors were elected at the Annual General Meeting.

We have provided information below about our directors, including their ages, committee positions, business experience for the past five years2017 annual general meeting of shareholders and the namesare scheduled to serve until our 2020 annual general meeting of other companies on which they serve, or have served, for the past five years. We have also provided information regarding each director’s specific experience, qualifications, attributes and skills that led the Board to conclude that each should serve as a director.shareholders.

As of February 15, 2016, we had the following directors on the Board and committees:

|

| | | | | | | | | | | | | | |

| Name | | Age | | Director Since | | Audit | | Compensation | | Corporate

Governance & Nominating | | Investment | | Risk |

| Class I Directors: | | | | | | | | | | | | | | |

| Christopher O’Kane | | 61 | | 2002 | | | | | | | | | | |

Heidi Hutter (1) | | 58 | | 2002 | | P | | | | P | | | | Chair |

| John Cavoores | | 58 | | 2006 | | | | | | | | | | P |

| Liaquat Ahamed | | 63 | | 2007 | | | | | | | | Chair | | P |

| Albert Beer | | 65 | | 2011 | | P | | | | | | | | P |

| Class II Directors: | | | | | | | | | | | | | | |

| Glyn Jones | | 63 | | 2006 | | | | | | | | P | | |

| Gary Gregg | | 60 | | 2013 | | P | | P | | | | | | P |

| Bret Pearlman | | 49 | | 2013 | | | | P | | | | P | | |

| Class III Directors: | | | | | | | | | | | | | | |

| Richard Bucknall | | 67 | | 2007 | | P | |

| | P | | | | P |

| Peter O’Flinn | | 63 | | 2009 | | P | | | | Chair | | | | |

| Ronald Pressman | | 57 | | 2011 | | | | Chair | | | | P | | |

| Gordon Ireland | | 62 | | 2013 | | Chair | | | | | | | | P |

| Karl Mayr | | 65 | | 2015 | | | | | | | | | | P |

_________

| |

(1) | Effective October 29, 2014, Ms. Hutter also serves as the Company’s Lead Independent Director. |

Glyn Jones. With effect from May 2, 2007, Mr. Jones was appointed as Chairman of the Board. Mr. Jones has been a director and a member of the Investment Committee since October 30, 2006. He also served as a non-executive director and Chairman of Aspen Insurance UK Limited (“Aspen U.K.”) between December 4, 2006 and May 6, 2014 and was a member of Aspen U.K.’s audit committee between September 4, 2006 and May 6, 2014. Mr. Jones is also the Chairman of Aldermore Group plc, chair of its corporate governance and nominating committee and a member of its compensation committee. Mr. Jones is also the Chairman of Aldermore Bank plc, Aldermore Group plc’s banking subsidiary. Between September 2012 and May 2015, Mr. Jones was the senior independent director, chair of the investment committee and audit committee member of Direct Line Insurance Group plc, a FTSE 100 company. He was also a director of UK Insurance Limited, a subsidiary of Direct Line, between October 2012 and May 2015. Mr. Jones was previously the Chairman of Hermes Fund Managers, BT Pension Scheme Management and Towry Holdings. Mr. Jones was the Chief Executive Officer of Thames River Capital LLP from October 2005 until May 2006. From 2000 to 2004, he served as Chief Executive Officer of Gartmore Investment Management in the United Kingdom. Prior to Gartmore, Mr. Jones was Chief Executive Officer of Coutts NatWest Group and Coutts Group, which he joined in 1997, and was responsible for strategic leadership, business performance and risk management. In 1991, he joined Standard Chartered, later becoming the general manager of Global Private Banking. Mr. Jones was a consulting partner with Coopers & Lybrand/Deloitte Haskins & Sells Management Consultants from 1981 to 1990.

Mr. Jones has over 25 years of experience within the financial services sector. He is the former chief executive officer of a number of large, regulated, international financial services groups and has served as chairman of the board in a number of other

financial services companies. As a result, Mr. Jones providesIn evaluating the Board leadership for a complex, global and regulated financial services business such as ours.

Christopher O’Kane. Mr. O’Kane has been our Chief Executive Officer and a director since June 21, 2002. He was also a director of Aspen U.K. between 2002 and 2014 and its Chief Executive Officer until January 2010. He also serves as a director on various other boards of the Company’s subsidiaries. Mr. O’Kane served as Chairman of Aspen Bermuda Limited (“Aspen Bermuda”) until December 2006. Prior to the creation of the Company, from November 2000 until June 2002, Mr. O’Kane served as a director of Wellington Underwriting plc and Chief Underwriting Officer of Lloyd’s Syndicate 2020 where he built his specialist knowledge in the fields of property insurance and reinsurance, together with active underwriting experience in a range of other insurance disciplines. From September 1998 until November 2000, Mr. O’Kane served as one of the underwriting partners for Syndicate 2020. Prior to joining Syndicate 2020, Mr. O’Kane served as deputy underwriter for Syndicate 51 from January 1993 to September 1998. Mr. O’Kane began his career as a Lloyd’s broker.

Mr. O’Kane has over 30 years of experience in the specialty re/insurance industry and is both a co-founder of our Company's business and its founding Chief Executive Officer. Mr. O’Kane brings his market experience and industry knowledge to Board discussions and is also directly accountable to the Board for the day-to-day management of the Company and the implementation of its business strategy.

Liaquat Ahamed. Mr. Ahamed has been a director of the Company since October 31, 2007. Mr. Ahamed has a background in investment management with leadership roles that include heading the World Bank’s investment division. From 2004, Mr. Ahamed has been an adviser to the Rock Creek Group, an investment firm based in Washington D.C. From 2001 to 2004, Mr. Ahamed was the Chief Executive Officer of Fischer Francis Trees & Watts, Inc., a subsidiary of BNP Paribas specializing in institutional single and multi-currency fixed income investment portfolios. Mr. Ahamed has been a director of the Rohatyn Group and related series of funds since 2005 and a membercomposition of the Board, of Trustees at the Brookings Institution and the Putnam Funds since 2012.

Mr. Ahamed has over 30 years of experience in investment management and previously served as the chief investment officer and Chief Executive Officer of Fischer Francis Trees & Watts, Inc. Mr. Ahamed’s investment management experience provides the Board with experience to oversee the Company’s investment decisions, strategies and investment risk appetite. As a result, Mr. Ahamed also serves as Chair of the Investment Committee and is a member of the Risk Committee.

Albert J. Beer. Mr. Beer has been a director of the Company since February 4, 2011 and a director of Aspen Bermuda since July 23, 2014. Since 2006, Mr. Beer has been the Michael J Kevany/XL Professor of Insurance and Actuarial Science at St John’s University School of Risk Management. From 1992 to 2006, Mr. Beer held various senior executive positions at American Re-Insurance Corporation (Munich Re America). Previously, from 1989 to 1992, Mr. Beer held various positions at Skandia America Reinsurance Corporation, including that of Chief Actuary. He also has been a board member of United Educators Insurance Company since 2006, having served as Vice-Chair from 2009 to 2013. Since 2009, Mr. Beer has been a Trustee Emeritus for the Actuarial Foundation, having served as a board member from 2006 until 2009. In 2013, Mr. Beer was elected as a member of the Board of the American Academy of Actuaries, having previously served on such board from 1992 until 1994 and from 1996 until 1999. Mr. Beer was a member of the Actuarial Standards Board, which promulgates standards for the actuarial profession in the United States, from 2007 to 2012 and was its Chair from 2010 to 2011. Mr. Beer previously served as a member of the Board of the Casualty Actuarial Society.

Mr. Beer has over 30 years of actuarial experience in the insurance industry. Mr. Beer’s roles at American Re-Insurance Corporation included the active supervision of principal financial and accounting officers. In addition, Mr. Beer has extensive experience in reserving matters, which constitute the principal subjective assessments within the Company’s accounts. As a result, Mr. Beer serves as a designated financial expert on the Company’s Audit Committee and is a member of the Risk Committee.

Richard Bucknall. Mr. Bucknall has been a director of the Company since July 25, 2007, a director of Aspen U.K. since January 14, 2008 and a director of Aspen Managing Agency Limited (“AMAL”) since February 28, 2008. Mr. Bucknall previously served as Chairman of the Compensation Committee of the Board (the “Compensation Committee”) between July 2007 and March 2015. Mr. Bucknall retired from Willis Group Holdings Limited where he was Vice Chairman from February 2004 to March 2007 and Group Chief Operating Officer from January 2001 to December 2006. While at Willis, Mr. Bucknall served as director on various boards within the Willis Group. He was also previously Chairman/Chief Executive Officer of Willis Limited from May 1999 to March 2007. Mr. Bucknall is currently the non-executive Chairman of FIM Services Limited and the non-executive Chairman of the XIS Group (comprised of Ins-Sure Holdings Limited, Ins-Sure Services Limited, London Processing Centre Ltd and LSPO Limited) where he is also a member of the audit committee. Mr. Bucknall is also currently a director of Tokio Marine Kiln Insurance Limited (formerly Tokio Marine Europe Insurance Limited), having previously served as chairman from December 2012 until February 2016 and as a director since 2010, where he is also a member of the audit and risk committees. Effective February 2016, Mr. Bucknall also serves as a director of Tokio Marine Kiln Syndicates Limited. Mr. Bucknall is a fellow of the Chartered Insurance Institute.

Mr. Bucknall has over 40 years of experience within the re/insurance broking industry and latterly served as Group Chief Operating Officer of the Willis Group. Since our revenues are primarily derived from brokers as distribution channels, Mr. Bucknall’s

background in the insurance broking industry provides the Board with an experienced perspective on broking relationships and their ability to impact our trading operations. Given his broad background across a number of operational disciplines, Mr. Bucknall is a member of the Audit, Risk and Corporate Governance and Nominating Committees.

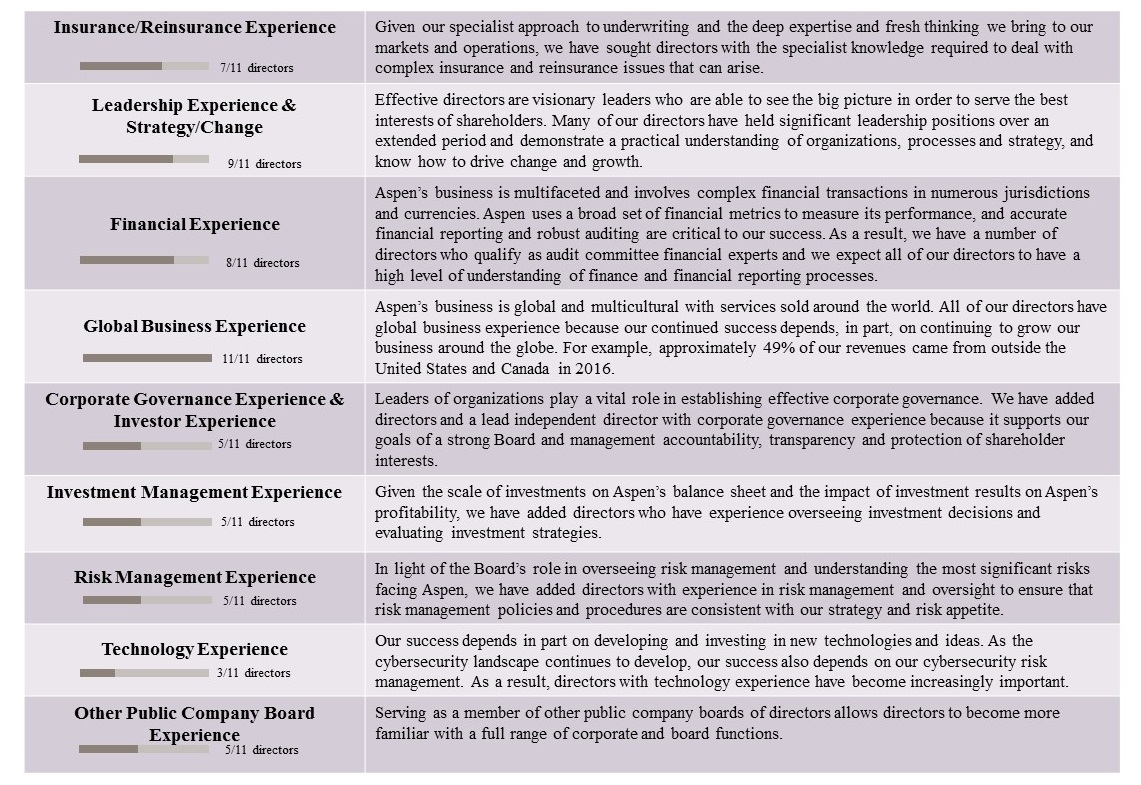

John Cavoores. Mr. Cavoores has been a director ofCommittee seeks to find and retain individuals who, in addition to having the Company since October 30, 2006. From October 5, 2010 through December 31, 2011, Mr. Cavoores was alsoqualifications set forth in Aspen’s Corporate Governance Guidelines, have the Co-Chief Executive Officer of Aspen Insurance, focusing on Aspen Insurance’s casualtyskills, experience and professional lines and U.S. property businesses, where he had executive oversight for Aspen Insurance’s U.S. platform. From January 1, 2012, Mr. Cavoores continued his roleabilities necessary to meet Aspen’s unique needs as a non-executive director ofhighly regulated company with operations around the Company. From September 2006 until March 2010, Mr. Cavoores was an advisor to Blackstone. During 2006, Mr. Cavoores was a Managing Director of Century Capital, a Boston-based private equity firm. From 2003 to 2005, Mr. Cavoores served as President and Chief Executive Officer of OneBeacon Insurance Company, a subsidiary ofglobe. As illustrated in the White Mountains Insurance Group. He was employed with OneBeacon from 2001 to 2005. Among his other positions, Mr. Cavoores was President of National Union Insurance Company, a subsidiary of AIG, Inc. He spent 19 years at Chubb Insurance Group, where he served as Chief Underwriting Officer, Executive Vice President and Managing Director of overseas operations, based in London. Mr. Cavoores has been the Chairman of Guidewire Software, Inc. since June 2015 and a director since December 2012. Mr. Cavoores has also been a director of Cunningham Lindsey, Inc. since October 2014. Mr. Cavoores previously served as a director of Alliant Insurance Holdings.

Mr. Cavoores has over 30 years of experience within the insurance industry having, among other positions, formerly served as President and Chief Executive Officer of OneBeacon Insurance. As a result, Mr. Cavoores providestable below, the Board consists of individuals with broad ranging businessthe skills, experience, with particular focus on insurance matters and strategies within the United States,backgrounds necessary to oversee Aspen’s efforts toward becoming a more effective and is a member of the Risk Committee.

Gary Gregg. Mr. Gregg has been a director of the Company since April 24, 2013. From May 2013 to 2015, Mr. Gregg was an advisor to Ortelius Ventures LLC. From 2011 to 2013, Mr. Gregg was engaged as a private consultant on a number of insurance and non-insurance related business purchase transactions. Prior to this, Mr. Gregg held various senior positions at Liberty Mutual Group from 1989 to 2011. From 2005 to 2011, Mr. Gregg served as President of Liberty Mutual Agency Corporation, one of Liberty Mutual Group’s four major business units. Prior to this, he served as President of Commercial Markets, another of the four major business units within Liberty Mutual Group from 1999 to 2005. Before joining Liberty Mutual Group, Mr. Gregg was a partner at KPMG Peat Marwick LLP from 1988 to 1989, where he also held various positions of increasing responsibility from 1979 to 1988. Mr. Gregg is currently a member of the executive committee, the chairman of the finance committee, and the vice-chairman of the nominating Committee of the Board of Trustees of the Museum of Science in Boston, Massachusetts, having previously served as a member of the board of governors. Mr. Gregg also serves as a trustee, member of the audit committee and chairman of the development committee at the Stimson Center. Mr. Gregg previously served as a member of the academic affairs committee and the dean’s executive council of the D’Amore School of Business at Northeastern University until 2015.

Mr. Gregg has over 25 years of experience within the insurance industry, with expertise in the U.S. property and casualty market. Mr. Gregg also has relevant entrepreneurial experience in running insurance companies through his various positions held at Liberty Mutual Group. Given his extensive operational background, Mr. Gregg also serves as a member of the Audit, Compensation and Risk Committees.

Heidi Hutter. Ms. Hutter has been a director of the Company since June 21, 2002 and Lead Independent Director since October 29, 2014. She has served as a non-executive director of Aspen U.K. since August 6, 2002 and as a director and Chair of AMAL, the managing agent of our Lloyd’s Syndicate 4711, since February 28, 2008. She has served as Chief Executive Officer of Black Diamond Group, LLC since 2001 and Manager of Black Diamond Capital Partners since 2005. Ms. Hutter began her career in 1979 with Swiss Reinsurance Company in New York where she specialized in the then new field of finite reinsurance. From 1993 to 1995, she was Project Director for the Equitas Project at Lloyd’s which became the largest run-off reinsurer in the world. From 1996 to 1999, she served as Chief Executive Officer of Swiss Re America and was a member of the Executive Board of Swiss Re in Zurich. Ms. Hutter is director of Shenandoah Life Insurance Company, a director of SBLI USA Life Insurance Company, Inc. and a director and Chair of the Audit Committee of Prosperity Life Insurance Group LLC (Shenandoah’s and SBLI’s holding company). Ms. Hutter previously served as a director and Chair of the audit committee of AmeriLife Group LLC and as a director of Aquila, Inc., Smart Insurance Company (formerly United Prosperity Life Insurance Company) and Talbot Underwriting and related corporate entities.

Ms. Hutter is a qualified actuary with over 35 years of experience within the re/insurance industry. Ms. Hutter is a recognized industry leader with relevant experience both in the United States and internationally. Ms. Hutter has particular insurance experience at Lloyd’s as she served as Project Director for the Equitas Project at Lloyd’s from 1993 to 1995, and having previously served on the board of Talbot Underwriting Ltd. (corporate member and managing agent of Lloyd’s syndicate) from 2002 to 2007. As a result of her experience, Ms. Hutter provides the Board with insight on numerous matters relevant to insurance practice. Ms. Hutter also serves as Chair of the Risk Committee and as a member of the Audit and Corporate Governance and Nominating Committees.

Gordon Ireland. Mr. Ireland has been a director of the Company since February 7, 2013. He worked at PricewaterhouseCoopers and its predecessor firms for 36 years until 2010 where he was a member of the U.K. Firms’ Supervisory Board for nine years, serving at various times as Chairman of the Senior Management Remuneration Committee and Deputy Chairman of the Supervisory Board

and was, for a number of years, Chairman of the PricewaterhouseCoopers’ partner admissions panel. Mr. Ireland was Chairman of the PricewaterhouseCoopers’ Global International Insurance Accounting Group. Mr. Ireland represented PricewaterhouseCoopers on The Institute of Chartered Accountants in England and Wales (“ICAEW”) Accounting sub-Committee. Mr. Ireland has also represented the ICAEW on the Federation des Experts Comptables European equivalent committee and was a member of the European Financial Reporting Advisory Group Financial Instruments Working Group. As of May 27, 2015, Mr. Ireland has been a director of Iccaria Insurance ICC Ltd, a subsidiary of Arthur J. Gallagher & Co. that focuses on longevity swaps for pension funds. Mr. Ireland has also been a director of Yorkshire Building Society Group since September 2015. Mr. Ireland served as a director of Global Insurance Company Limited between March 2011 and December 2014. From July 2010 until June 2015, Mr. Ireland was a director of L&F Holdings Limited and Chief Executive of L&F Indemnity Limited, the professional indemnity captive insurance group which serves the PricewaterhouseCoopers network. He also served as a director of Lifeguard Insurance (Dublin) Limited, Catamount Indemnity Limited and Professional Asset Indemnity Limited from July 2010 to June 2015.

Mr. Ireland has over 35 years of experience within the financial services sector having worked at PricewaterhouseCoopers. As a result of his audit-led exposure to the London Market and generalefficient insurance and reinsurance markets throughout his career, Mr. Ireland provides strong insurance audit skillscompany, while mitigating risk and technical accountancy expertise to our Board. Asoperating within a result, he serves as Chaircomplex regulatory environment.

The following tables provide information about each of the Audit Committee, on which he is also a designated financial expert,directors’ principal occupation and as a member ofbusiness experience, and highlights his or her particular skills, qualifications and experience that support the Risk Committee.

Karl Mayr. Mr. Mayr has been a director of the Company since December 2, 2015. Mr. Mayr has also served as a director of Aspen U.K. and a member of its Risk Committee since June 2015. Mr. Mayr has served as a Director of Würzburger Versicherungs-AG since 2004. Mr. Mayr worked at Axis Re Europe and Axis Reinsurance from 2003 to 2014 where his most recent roles were as Vice Chairman of Axis Reinsurance and President and Chief Executive Officer of Axis Re Europe. Prior to this, Mr. Mayr was at GE Frankona Reinsurance Company.

Mr. Mayr has over 30 years of experience in the reinsurance sector, primarily in Europe, across a number of product lines in both an underwriting capacity and in managerial roles. As a result of his experience, Mr. Mayr also serves as a member of the Risk Committee.

Peter O’Flinn. Mr. O’Flinn has been a director of the Company since April 29, 2009 and a director of Aspen Bermuda since February 16, 2010. From 1999 to 2003, Mr. O’Flinn was Co-Chairman of LeBoeuf, Lamb, Greene & MacRae. He previously served as a director and audit committee member of Sun Life Insurance and Annuity Company of New York from 1998 until August 2013, and of Euler ACI Holdings, Inc. from 1998 until December 2013.

Mr. O’Flinn is a qualified lawyer with over 25 years of private practice experience. Mr. O’Flinn is a corporate lawyer and former Co-Chairman of LeBoeuf, Lamb, Greene & MacRae, as well as former chair of their corporate practice, and has extensive experience on legal matters relevant to both the re/insurance industry and public company legal matters generally. Mr. O’Flinn provides the Board with input on corporate initiatives and regulatory and governance matters. As a result of his experience, Mr. O’Flinn serves as the Chairconclusion of the Corporate Governance and Nominating Committee and as a member ofthat the Audit Committee.

Bret Pearlman. Mr. Pearlman has been a director of the Company since July 24, 2013. Since 2004, Mr. Pearlman has been a Managing Director of Elevation Partners, where he is also a Co-Founder. In October 2014, Mr. Pearlman also became a Manager of HRS 1776 Partners. Previously, Mr. Pearlman worked for The Blackstone Group where he served as a Senior Managing Director from 2000 to 2004 and held various roles from 1989 to 2000. Mr. Pearlman was a board member of Forbes Media LLC from 2009 to 2014. He joined the board of CHM Holdings LLC in 2015. Mr. Pearlman continuesqualified to serve on the board of the Youth Renewal Fund Charity and the Jericho Athletic Association charity. Board.

Mr. Pearlman has over 25 years of experience within private equity, providing a strong understanding of performance management, business models, corporate finance and capital management. His current role as Managing Director at Elevation Partners provides significant experience of the digital world and technology. As a result of his experience, Mr. Pearlman also serves as a member of the Compensation and Investment Committees.Ronald Pressman. Mr. Pressman has been a director of the Company since November 17, 2011. Mr. Pressman was appointed as Executive Vice President and Chief Executive Officer of TIAA Institutional Financial Services in September 2015, having previously served as Chief Operating Officer of TIAA from January 2012 until September 2015. Previously, he worked at General Electric (“GE”) Corporation for 31 years, where he was most recently President and Chief Executive Officer of GE Capital Real Estate from 2007 until 2011. From 2000 to 2007, Mr. Pressman also served as President and Chief Executive Officer of GE Asset Management and as Chairman, Chief Executive Officer and President of Employers Reinsurance. Earlier in his career, Mr. Pressman led GE energy businesses in Europe, the Middle East, Africa, Southwest Asia and the United States. Mr. Pressman previously served as a member of the board of New York Life Insurance Company from November 2011 until January 2012. He currently serves as Chairman of the national board of A Better Chance, a non-profit organization which provides leadership development opportunities for children of color in the United States. He is also a director of Pathways to College, a non-profit organization that prepares young people from deprived communities for college. Mr. Pressman is also a charter trustee of Hamilton College. |

| | |

| | Position, Principal Occupation, Business Experience and Directorships |

| | • Chairman, Old Mutual Wealth — 2016 to present • Chairman, Aldermore Group PLC and Aldermore Group Bank PLC — 2014 to 2017 • Senior Independent Director and Chairman of the Investment Committee, Direct Line Insurance Group — 2012 to 2015 • Director, UK Insurance Limited — 2012 to 2015 • Non-Executive Director and Chairman, Aspen U.K. — 2006 to 2014 • Chairman, Towry Holdings — 2006 to 2012 • Chairman, BT Pension Scheme Management — 2010 to 2011 • Chairman, Hermes Fund Managers — 2008 to 2011 • Chief Executive Officer, Thames River Capital LLP — 2005 to 2006 • Chief Executive Officer, Gartmore Investment Management — 2000 to 2004 • Chief Executive Officer, Coutts NatWest Group and Coutts Group — 1997 to 2000 • General Manager, Global Private Banking, Standard Chartered — 1991 to 1997 • Consulting Partner, Coopers & Lybrand/Deloitte Haskins & Sells Management Consultants — 1981 to 1990

|

| Glyn Jones | | Skills and Qualifications |

Age: 65 | | Mr. Jones has over 30 years of experience within the financial services sector. He is the former chief executive officer of a number of large, regulated, international financial services groups and has served as chairman of the board in a number of other financial services companies. As a result, Mr. Jones provides the Board leadership for a complex, global and regulated financial services business such as ours and is also a member of the Investment Committee.

|

| Chair of the Board | |

| since May 2, 2007 | |

Director of Aspen

| |

| since October 30, 2006 | |

| Other Directorships | |

| Old Mutual Wealth | |

|

| | |

| | Position, Principal Occupation, Business Experience and Directorships |

| | • Group Chief Executive Officer, Aspen Insurance Holdings Limited — 2002 to present

• Director, Blue Marble Micro Insurance — 2016 to present

• Director, Aspen U.K. — 2002 to 2014

• Chief Executive Officer of Aspen U.K. — 2002 to 2010

• Chairman, Aspen Bermuda Limited — 2002 to 2006

• Director, Chief Underwriting Officer, Lloyd’s Syndicate 2020 — 2000 to 2002

• Underwriting Partner, Lloyd’s Syndicate 2020 — 1998 to 2000

• Deputy Underwriter, Syndicate 51 — 1993 to 1998

|

| Christopher O’Kane | | Skills and Qualifications |

Age: 63 | | Mr. O’Kane has extensive experience in the specialty re/insurance industry and is both a co-founder of our Company’s business and its founding Chief Executive Officer. Mr. O’Kane brings his market experience and industry knowledge to Board discussions and is also directly accountable to the Board for the day-to-day management of the Company and the implementation of its business strategy. |

| Group Chief Executive Officer and Director | |

| since June 21, 2002 | |

| Other Directorships | |

| Blue Marble Micro Insurance | |

Mr. Pressman has over 30 years of experience within the financial services sector, in particular real estate, asset management and reinsurance, having worked at GE for over 30 years and served as Chief Operating Officer of TIAA until his appointment as Executive Vice President and Chief Executive Officer of TIAA Institutional Financial Services in September 2015. With his varied experience across such sectors and having held senior positions, Mr. Pressman provides further insight on a wide-range of matters including operations, insurance industry and investment management expertise. As a result of his experience, Mr. Pressman also serves as Chair of the Compensation Committee and as a member of the Investment Committee.

Review and Approval of Transactions with Related PersonsThe review and approval of any direct or indirect transactions between the Company and “related persons” (directors, executive officers or any of their immediate family members) is governed by our Code of Business Conduct and Ethics, which provides guidelines for any transaction which may create a conflict of interest between us and our employees, officers or directors and members of their immediate family. Pursuant to our Code of Business Conduct and Ethics, we will review personal benefits received, personal financial interest in a transaction and certain business relationships in evaluating whether a conflict of interest exists. The Audit Committee is responsible for applying the Company’s conflict of interest policy and approving certain individual transactions. |

| | |

| | Position, Principal Occupation, Business Experience and Directorships |

| | • Vice Chair, United Educators Insurance Company — 2009 to 2013; Board Member — 2006 to present • Director, Aspen Bermuda Limited — 2014 to present • Trustee Emeritus, Actuarial Foundation — 2009 to present; Board Member — 2006 to 2009 • Michael J. Kevany/XL Professor of Insurance and Actuarial Science at St John’s University, School of Risk Management — 2006 to present • Board Member, American Academy of Actuaries — 2013 to 2016 • Chair, Actuarial Standards Board — 2010 to 2011; Board Member — 2007 to 2012 • Senior Executive, American Re-Insurance Corporation (Munich Re America) — 1992 to 2006 • Senior Executive, Skandia America Reinsurance Corporation — 1989 to 1992 • President and Board member, Casualty Actuarial Society — 1995

|

| Albert Beer | | Skills and Qualifications |

Age: 67 | | Mr. Beer has over 30 years of actuarial and management experience in the insurance industry. Mr. Beer’s roles at American Re-Insurance Corporation included the active supervision of principal financial and accounting officers. In addition, Mr. Beer has extensive experience in reserving matters, which constitute the principal subjective assessments within the Company’s accounts. As a result, Mr. Beer serves as a designated financial expert on the Company’s Audit Committee and is a member of the Risk Committee. |

| Director of Aspen | |

| since February 4, 2011 | |

| Other Directorships | |

| Aspen Bermuda Limited, American Academy of Actuaries, United Educators Insurance Company | |

|

| | |

| | Position, Principal Occupation, Business Experience and Directorships |

| | • Director, Fidentia Fortuna Holdings Limited — 2018 to present • Director, Aspen Capital Markets — 2017 to present • Managing Partner, Gallatin Point Capital LLC — 2017 to present • Advisor, BlackRock Inc.’s alternative investment unit — 2017 to present • Director, Northeast Bancorp — 2010 to present • Director, PennyMac Financial Services Inc. — 2008 to present • Director, Alignment Artist Capital LLC — 2015 to 2017 • Director, Alliance Partners LLC — 2011 to 2017 • Head, BlackRock Alternative Investors, BlackRock Inc. — 2010 to 2017 • Co-Head and Chief Investment Officer, BlackRock Inc.’s alternative investment unit — 2010 to 2017 • Managing Director and Global Operating Committee Member, Blackrock Inc. — 2010 to 2017 • Director, PennyMac Mortgage Investment Trust — 2009 to 2013 • Director, Corelogic, Inc. (and predecessor, First American Corporation) — 2009 to 2011 • Director, Cyrus Holdings Ltd — 2005 to 2009 • Non-Executive Director, Aspen — 2002 to 2003 and 2007 to 2011

|

| Matthew Botein | | Skills and Qualifications |

Age: 44 | | Mr. Botein has approximately 20 years of experience in the financial services industry, primarily managing portfolio investments in the banking, insurance, asset management, capital markets and financial processing sectors. As a result of his extensive financial services and investment management experience, Mr. Botein also serves as Chair of the Investment Committee. |

| Director of Aspen | |

| since February 7, 2017 | |

| Other Directorships | |

| Fidentia Fortuna Holdings Limited, PennyMac Financial Services Inc., Northeast Bancorp, Aspen Capital Markets | |

|

| | |

| | Position, Principal Occupation, Business Experience and Directorships |

| | • Chairman, Guidewire Software, Inc. — 2015 to 2016; Director — 2012 to 2016 • Director, Cunningham Lindsey, Inc. — 2014 to 2016 • Co-Chief Executive Officer, Aspen Insurance business segment — 2010 to 2011 • Director, Alliant Insurance Holdings — 2007 to 2012 • Advisor, Blackstone — 2006 to 2010 • Managing Director, Century Capital — 2006 • President and Chief Executive Officer, OneBeacon Insurance Company — 2003 to 2005; Managing Director — 2001 to 2005 • President, National Union Insurance Company, a subsidiary of AIG, Inc. — 1998 to 2000 • Chief Underwriting Officer, Executive Vice President, Managing Director of Overseas Operations, Chubb Insurance Group — 1979 to 1998

|

| John Cavoores | | Skills and Qualifications |

Age: 60 | | Mr. Cavoores has over 30 years of experience within the insurance industry having, among other positions, formerly served as President and Chief Executive Officer of OneBeacon Insurance Company. As a result, Mr. Cavoores provides the Board with broad ranging business experience, with particular focus on insurance matters and strategies within the United States, and is a member of the Risk and Corporate Governance and Nominating Committees. |

| Director of Aspen | |

| since October 30, 2006 (Non-Executive Director since January 1, 2012) | |

| Other Directorships | |

| None | |

|

| | |

| | Position, Principal Occupation, Business Experience and Directorships |

| | • Member of the Executive Committee, Nominating Committee and Chair of the Finance Committee, Board of Trustees Museum of Science in Boston, Massachusetts — 2015 to present; Overseer and member of the Audit Committee — 2006 to 2014 • Trustee, Member of the Audit Committee and Chairman of the Development Committee, Stimson Center, Washington DC — 2012 to present • Ortelius Ventures LLC — 2013 to 2015 • Academic Affairs Committee and Dean’s Executive Council, D’Amore School of Business, Northeastern University — 2003 to 2015 • Private Consultant — 2011 to 2013 • President of Liberty Mutual Agency Corporation — 2005 to 2011 • President of Commercial Markets, Liberty Mutual — 1999 to 2005; Senior Executive — 1989 to 1999 • Partner, KPMG — 1988 to 1989; Executive — 1979 to 1988 |

| Gary Gregg | | Skills and Qualifications |

Age: 62 | | Mr. Gregg has over 30 years of experience within the insurance industry, with expertise in the U.S. property and casualty market. Mr. Gregg also has relevant entrepreneurial experience in running insurance companies through his various positions held at Liberty Mutual Group, which included overseeing multiple business acquisitions and subsequent integrations; directing overall IT strategy for his business units, with annual budgets typically in the range of $400 million, including major claims, underwriting and CRM system implementations; and experience managing multiple insurance distribution channels including large national brokerage, the U.S. independent agency system and direct selling. Given his extensive operational background, Mr. Gregg also serves as Chair of the Risk Committee and is a member of the Audit and Compensation Committees. |

| Director of Aspen | |

| since April 24, 2013 | |

| Other Directorships | |

| Museum of Science, Boston; Stimson Center, Washington DC | |

|

| | |

| | Position, Principal Occupation, Business Experience and Directorships |

| | • Director, SBLI USA Life Insurance Company, Inc. — 2014 to present • Director, Prosperity Life Insurance Group, LLC — 2013 to present; Audit Committee Chair — 2016 to present • Director, Shenandoah Life Insurance Company — 2012 to present; Audit Committee Chair — 2012 to 2015 • Director and Chair, Aspen Managing Agency Limited (“AMAL”) — 2008 to present • Manager, Black Diamond Capital Partners — 2005 to present • Chief Executive Officer, Black Diamond Group, LLC — 2001 to present • Non-Executive Director, Aspen Insurance U.K. Ltd. — 2002 to 2016 • Director and Audit Committee Chair, AmeriLife Group LLC, DE, US — 2007 to 2015 • Director, Smart Insurance Company — 2010 to 2013 • Director, Talbot Underwriting — 2002 to 2007 • Chief Executive Officer, Swiss Re America — 1996 to 1999 • Executive Board Member, Swiss Re Zurich — 1996 to 1999 • Project Director, Equitas Project — 1993 to 1995 • Executive, Swiss Re, NY — 1979 to 1993 |

| Heidi Hutter | | Skills and Qualifications |

Age: 60 | | Ms. Hutter has over 35 years of management and actuarial experience within the re/insurance industry. Ms. Hutter is a recognized industry leader with relevant experience both in the United States and internationally. Ms. Hutter has particular insurance experience at Lloyd’s where she served as Project Director for the Equitas Project from 1993 to 1995, and having previously served on the board of Talbot Underwriting Ltd. (corporate member and managing agent of Lloyd’s syndicate) from 2002 to 2007. As a result of her experience, Ms. Hutter provides the Board with insight on numerous matters relevant to insurance practice. Ms. Hutter also serves as Chair of the Corporate Governance and Nominating Committee and as a member of the Audit and Risk Committees.

|

| Lead Independent Director | |

| since October 29, 2014 | |

| Director of Aspen | |

| since June 21, 2002 | |

| Other Directorships | |

| SIBLI USA Life Insurance Company, Inc.; Prosperity Life Insurance Company Group, LLC; Shenandoah Life Insurance Company; AMAL | |

|

| | |

| | Position, Principal Occupation, Business Experience and Directorships |

| | • Director, Iccaria Insurance ICC Ltd — 2015 to present • Director, Yorkshire Building Society Group — 2015 to present • Director, L&F Holdings Limited — 2010 to 2015 • CEO, L&F Indemnity Limited — 2010 to 2015 • Director, Lifeguard Insurance (Dublin) Limited — 2010 to 2015 • Director, Catamount Indemnity Limited — 2010 to 2015 • Director, Professional Asset Indemnity Limited — 2010 to 2015 • Director, Global Insurance Company Limited — 2011 to 2014 • U.K.Firms’ Supervisory Board, Chairman of the Senior Management Remuneration Committee, Deputy Chairman of the Supervisory Board,Chairman of the PricewaterhouseCoopers LLP (“PwC”) partner admissions panel, Chairman of the Global International Insurance Accounting Group, PwC’s representative on The Institute of Chartered Accountants in England and Wales (“ICAEW”) Accounting sub-Committee,PwC — 1974 to 2010 • ICAEW representative on the Federation des Experts Comptables European equivalent committee — For a period of time as Partner at PwC • Member of the European Financial Reporting Advisory Group Financial Instruments Working Group — For a period of time as Partner at PwC |

| Gordon Ireland | | Skills and Qualifications |